Financial Protection Against Everyday Accidents

Accidents can happen anywhere and to anyone, often when least expected. Recent research highlights just how common accidents are and the financial strain they can cause without proper protection. 🤕 The Reality of Everyday Risks Falls at home are the most frequent type of accident for adults, accounting for 34% of incidents. Women are more […]

What is Loan to Value?

The Loan-to-Value (LTV) ratio is a financial metric used by lenders to assess risk when approving a mortgage or loan. It compares the loan amount to the appraised value or purchase price of a property, expressed as a percentage. Understanding LTV helps borrowers make informed financial decisions, impacting loan approval, costs, and overall mortgage terms. Find out […]

Are you considering expanding your property portfolio?

If you are already in the market or considering expanding your portfolio, 2025 presents a prime opportunity to think beyond the immediate rental yields and focus on long-term goals. For example, a well-planned exit strategy is essential for maximising the value of your buy-to-let investments and ensuring they align with your future financial aspirations. 🍃 […]

What is porting a mortgage?

Porting a mortgage refers to the process of transferring an existing mortgage from one property to another when moving homes. It allows homeowners to retain the same lender, interest rate, and mortgage terms while switching properties, potentially avoiding penalties for breaking their mortgage early. Find out more in my YouTube video below. Got a question? […]

The Mortgage Market 2025: What You Need To Know

You may be wondering how the expected changes in the market for 2025 could affect you. The outlook could be promising, with potential improvements in affordability, opportunities to secure better rates, and tailored support for those who need it. 🍃 Improving Affordability & Lower Rates 2025 is forecast to bring some relief as interest rates […]

Fixed-rate mortgage 2025. What are people doing right now?

I often get these questions from my clients; “What are people doing at the minute?” “Are they going for a two year fixed-rate mortgage 2025 or a five year fixed?” And my answer to this, there is no real answer to this because it’s very, very different for everyone. Watch my YouTube video below where […]

Stay Fit with Gym Discounts & Wellness Perks Through Your Insurance Plan

While staying on track can be difficult, your protection plan may offer more than financial security. Many policies include value-added benefits designed to support you in reaching your goals… 🌿 Health & Fitness If health and fitness is top of your list this year, the extra benefits from your insurance policy could make sticking to […]

What does an Estate Agent do?

On a mortgage podcast in 2023, I interviewed Chris Nathan, owner and founder of Hound & Porter Estate Agency in Reigate, Surrey, to find out his top tips when it comes to working with an Estate Agency. I asked him the following: What should people expect from an estate agency when they start looking for […]

Making Green Finance Work For You

Sustainable living isn’t just good for the planet, it’s good for your wallet too… Green finance options are designed to help homeowners invest in eco-friendly improvements while reaping long-term financial rewards. Whether you’re upgrading your home or purchasing a new one, green finance can pave the way to a more sustainable future. One of the […]

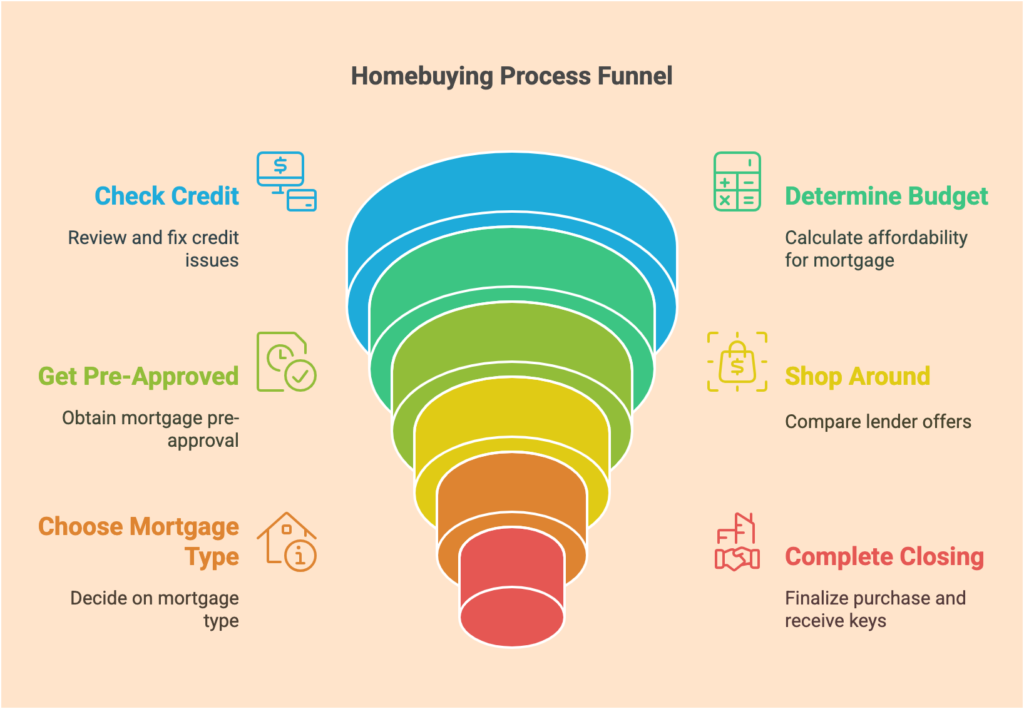

Navigating the Mortgage Process: A Step-by-Step Guide for Homebuyers

Buying a home can be an exciting yet overwhelming experience, especially when it comes to securing a mortgage. Here’s a step-by-step guide to help you navigate the mortgage process with confidence: Remember, working with an experienced mortgage broker can help simplify this process and ensure you’re getting the best possible deal for your unique situation.